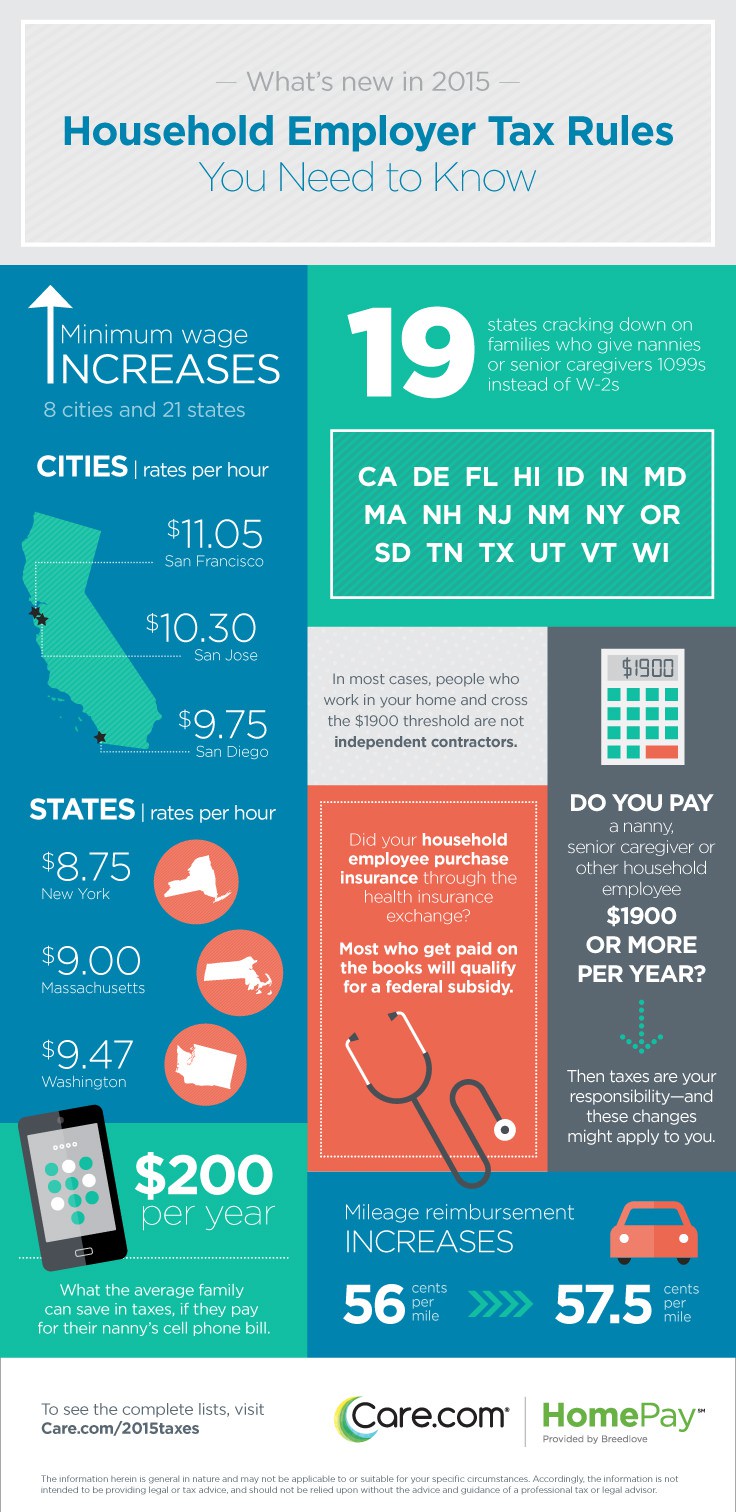

When you pay a household employee (like a nanny, babysitter, senior caregiver, housekeeper, etc.) $1900 or more per year, you may have to pay taxes. Here are some of the new tax laws in 2015 that may apply. Scroll to the bottom of the page for more detailed explanations.

- Mileage Reimbursement Increases

Does your nanny drive your kids to soccer practice? Does your senior caregiver run errands for you? If your employee is regularly using a personal car for work, she should be repaid.The IRS has a standard mileage rate that is used to calculate the cost of cost of gas, maintenance and depreciation of a car used for business purposes. In 2015 that rate increased from 56 cents per mile to 57.5 cents per mile.

Learn more about How to Reimburse a Nanny for Gas and Mileage.

- Minimum Wage Increases

The minimum wage changed in 21 states and 8 cities for 2015. Here are the new rates.Find out more about paying your caregiver minimum wage.

States Changes:

State Wage Effective Alaska $8.75 2/24 Arkansas $7.50 1/1 Arizona $8.05 1/1 Colorado $8.23 1/1 Connecticut $9.15 1/1 Delaware $8.25 6/1 Florida $8.05 1/1 Hawaii $7.75 1/1 Massachusetts $9.00 1/1 Maryland $8.00 and $8.25 1/1 and 7/1 Michigan $8.15 1/1 Missouri $7.65 1/1 Montana $8.05 1/1 Nebraska $8.00 1/1 New Jersey $8.38 1/1 New York $8.75 1/1 Oregon $9.25 1/1 South Dakota $8.50 1/1 Vermont $9.15 1/1 Washington $9.47 1/1 Washington DC $10.50 7/1 West Virginia $8.00 1/1

City Changes:

| City | Wage | Effective |

| Chicago | $10.00 | 7/1 |

| Louisville | $7.75 | 7/1 |

| Montgomery County, MD | $9.55 | 10/1 |

| Prince George County, MD | $9.55 | 10/1 |

| San Diego | $9.75 | 1/1 |

| San Francisco | $11.05 and $12.25 | 1/1 and 5/1 |

| San Jose | $10.30 | 1/1 |

| Seattle | $10.00 | 4/1 |

- States Focus on Worker Misclassification

Do you have your nanny fill out a W-2 or a 1099 tax form? If you said 1099, you should read this part carefully!Most nannies and people who work in your home are considered household employees by the IRS, not independent contractors. So they should receive a W-2.

The Department of Labor recently awarded $10.2 million in grants to 19 states in order to enhance enforcement of worker misclassification (calling someone an independent contractor when they're really an employee).

In 2015, these states will be paying closer attention to families who misfile.

- California

- Delaware

- Florida

- Hawaii

- Idaho

- Indiana

- Maryland

- Massachusetts

- New Hampshire

- New Jersey

- New Mexico

- New York

- Oregon

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Wisconsin

Read more about What's Wrong With Hiring a Nanny as an Independent Contractor.

- Health Insurance Subsidy Available

If you or your caregiver purchased a health insurance policy through the health care exchange, you are eligible to apply for a federal subsidy for the first time this tax season. You need to earn less than 400 percent of the federal poverty level and get paid on the books. (Check out this calculator from the Kaiser Foundation to see if you qualify.)Get advice on How to Set Up Health Insurance for a Nanny.

- Tax Breaks for Cell Phone Bills

The IRS ruled that cell phone service is considered non-taxable compensation for caregivers. What does that mean? If you pay for your nanny's cell phone, you don't have to pay taxes on it — and you could save about $200 per year!

Tiffany Smith is the senior associate editor here at Care.com. She has written for All You, Time for Kids and the Boston Globe. And as a former babysitter, she knows a lot about fun games to play with kids. Getting them to eat their veggies — thats a different story! Follow her on Twitter @tiffanyiswrite.

* The tax information contained in this article should not be used for any actual caregiver relationship without the advice and guidance of a professional tax advisor who is familiar with all the relevant facts. The information contained herein is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for your specific circumstances and may require consideration of other matters.