Many veterans and their spouses are unaware of a benefit they are entitled to that could help them pay for care as they age, says certified elder law attorney Denise N. Yurkofsky. While the Aid and Attendance benefit can be extremely helpful, there are strict eligibility requirements regarding income, assets, need and service.

- The Aid and Attendance benefit can help veterans finance services that could make a significant difference in their lives, says Yurkofsky. Some veterans qualify for a full benefit; others for a partial benefit.

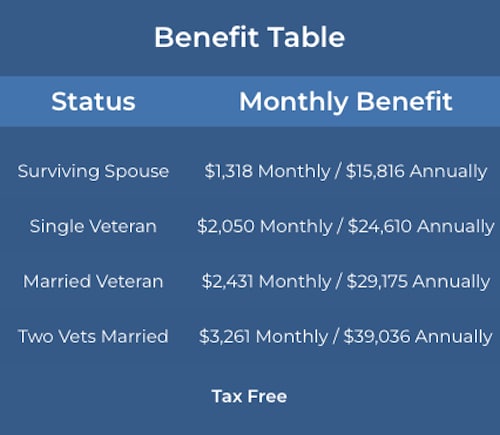

- The tax-free benefit covers both home care and assisted living or nursing home costs. Spouses of eligible veterans can also receive this benefit, but will qualify for less money than the actual veteran.

Eligibility requirements

You get a VA pension and you meet at least one of the requirements listed below:

- You need another person to help you perform daily activities, like bathing, feeding, and dressing.

- You have to stay in bed — or spend a large portion of the day in bed — because of illness.

- You are a patient in a nursing home due to the loss of mental or physical abilities related to a disability.

- Your eyesight is limited (even with glasses or contact lenses you have only 5/200 or less in both eyes; or concentric contraction of the visual field to 5 degrees or less).

You may be eligible for a separate Housebound benefit if you get a VA pension, and you spend most of your time in your home because of a permanent disability (a disability that doesn’t go away).

How to apply for the benefit

Here’s how you can apply for VA Aid and Attendance or Housebound benefits:

Send a completed Aid and Attendance VA form to your pension management center (PMC)

Fill out VA Form 21-2680 (Examination for Housebound Status or Permanent Need for Regular Aid and Attendance) and mail it to the PMC for your state. (You can locate your local PMC here.) A doctor can fill out the examination information section.

You can also include with your VA form:

- Other evidence, like a doctor’s report, that shows you need Aid and Attendance or Housebound care.

- Details about what you normally do during the day and how you get to places.

- Details that help show what kind of illness, injury, or mental or physical disability affects your ability to do things, like take a bath, on your own.

Nursing home residents will also need to fill out a Request for Nursing Home Information in Connection with Claim for Aid and Attendance (VA Form 21-0779).

Head to va.gov for more details.