From stay-at-home mandates, to the Families First Act, and now the Coronavirus Aid, Relief, and Economic Security (CARES) Act, there is a lot of new information for families to take in. Understandably, it can feel overwhelming to try and figure out what applies to how you manage your nanny, senior caregiver or other household employee.

To make things easier for you, click on the topic you’re interested in below for quick access to some common questions we’ve received about paid sick leave, paid family leave, stay-at-home orders, unemployment benefits, and tax credits.

Families First Act and CARES Act benefits

Stay-at-home orders and work eligibility

Unemployment and reduced hours

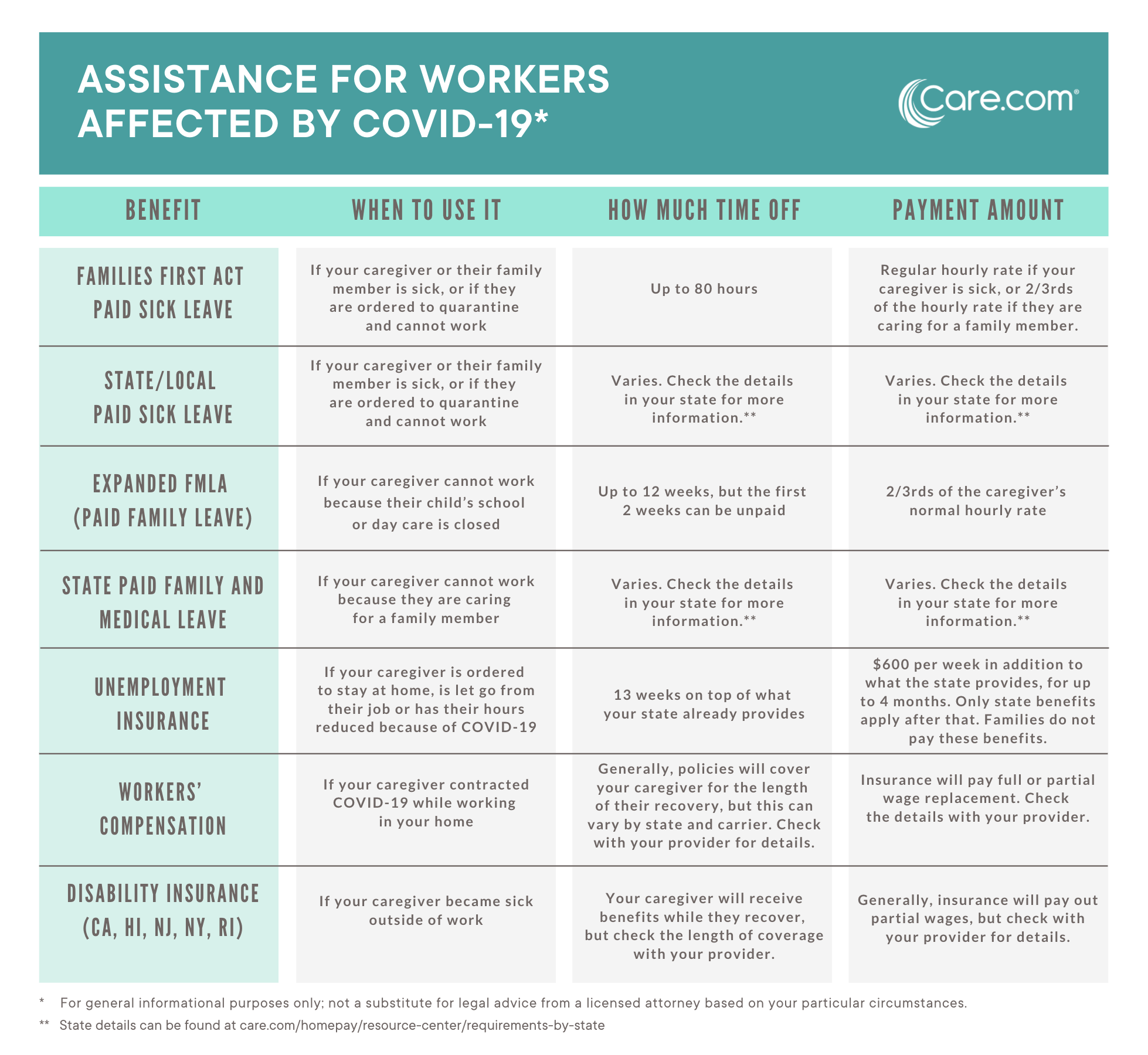

What are some of the benefits my nanny or caregiver may be entitled to if they cannot work because of the COVID-19 virus?

The nature of why your employee cannot be in your home will depend on what benefits they are eligible for. Consult the chart below to see which benefits generally apply to your specific situation and check the details in your state for additional information..

How does the Families First Act impact how I manage my nanny or caregiver?

How does the Families First Act impact how I manage my nanny or caregiver?

The Families First Act has two components that you should know about:

It requires you to provide up to 80 hours of paid sick time to your employee if they contract COVID-19 or are caring for a family member that is sick with the coronavirus.

It requires you to provide up to 12 weeks of family leave (10 weeks are paid) if your employee cannot work because their child’s school or daycare is closed.

The Department of Labor (DOL) can rule that a household employer is exempt from these requirements, but this is on a one-off basis. We have a more in-depth article on the Families First Act that you can reference for more information. Additionally, the DOL is continuing to update their guidance on this law and you can visit their website if you have a question that is not currently addressed here.

Can I leverage any tax credits to offset my cost of paying these benefits?

Yes, as long as you are paying your nanny or caregiver legally, you will be able to take a tax credit that will reimburse you for the cost of paid sick leave and paid family leave. These credits can potentially be thousands of dollars depending on how much paid leave your employee needs to use. The IRS will handle the tax credit and has indicated that reimbursements will be paid as quickly as possible.

Can I take the Employee Retention Credit mentioned in the CARES Act?

No, the IRS does not consider a household employer to be operating a trade or business. Therefore, families with nannies, senior caregivers and other household employees are not eligible for the Employee Retention Credit.

If my employee has another job and just works with us periodically, am I required to provide paid sick time/paid leave benefits?

Yes, the Families First Act does provide part-time employees with paid sick time and expanded FMLA (paid sick leave) benefits. However, the amount of benefits are calculated based on the average number of weekly hours your employee works in a two week period so you’ll need to do these calculations to determine your requirements.

How does the CARES Act impact me and my caregiver?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act expands unemployment benefits to employees that are unable to work or become partially employed because of the COVID-19 virus. If your nanny or caregiver falls on hard times, they can earn $600 per week for up to 4 months in addition to the normal weekly unemployment benefits they would receive from the state.

Additionally, your caregiver may receive a one-time payment of up to $1,200, plus an additional $500 for each child they have. They just need to have a valid Social Security number and have filed a 2018 or 2019 tax return.

If my caregiver is not being paid on the books, am I or my caregiver eligible for benefits?

No, none of the paid time off benefits, unemployment compensation, stimulus checks or tax credits would be available to you or your employee. However, if you call HomePay wanting to get your nanny or caregiver on the books, we can retroactively file all the tax returns you’ve missed and get your employee a W-2 so you can potentially become eligible. Call us at (888) 273-3356 and we can start this process for you immediately.

Stay-at-Home Orders and Work Eligibility

If my employee cannot work because a stay-at-home, shelter-in-place or quarantine order is given, what benefits do they qualify for?

Your nanny or caregiver should be able to qualify for unemployment benefits to make ends meet while they are out of work. Between the Families First Act and the CARES act, benefits have been expanded an additional 13 weeks for caregivers that are temporarily or permanently laid off because of the coronavirus. Additionally, benefits have been increased by $600 per week for up to 4 months.

If my employee does not qualify as an essential worker and cannot come to work, am I required to continue paying them?

No, you are not required to continue paying your employee, but you are welcome to do so. If you do not continue to pay your employee, they should qualify for unemployment benefits from the state while they are out of work.

If my employee qualifies as an essential worker, do I have to pay them if they still elect to stay home? If so, what are rules for doing this?

If your employee is able to work, but chooses not to do so, you’re not required to pay them. You are only required to pay out paid sick leave and/or expanded FMLA benefits if your employee is able to work, but physically cannot do so because they are sick, caring for a family member that is sick, or caring for their child because their school or daycare is closed due to COVID-19.

Are my employee or I required to let each other know if we have COVID-19 or have been exposed to it?

As a matter of safety and transparency, it’s recommended for you and your employee to inform each other if you become sick or could become sick even though no federal law mandates it. However, if you live in California, employers and employees must let each other know in writing (email or text message suffices) within 1 business day if they’ve been exposed to COVID-19.

Unemployment and Reduced Hours

I need to cut my full-time nanny’s hours back to part-time during this crisis? Can they qualify for unemployment benefits?

This varies by state, but generally speaking, your employee can qualify for benefits if their hours are reduced by 40-60%.

If I reduced my employee’s hours, can they receive partial unemployment benefits AND paid leave benefits because they have to miss additional days to care for their own kids?

Generally, employees cannot receive unemployment benefits if they are already receiving benefits from their employer.

Can I let my employee go if they choose not to work for my family due to health concerns?

Yes, you can let your employee go if they are unwilling to work for your family due to concerns about the coronavirus. You’re welcome to re-hire them at a later date if you choose to do so.

I just hired my caregiver in January and need to furlough them. Will they qualify for benefits?

This decision will vary by state. Your employee can file for unemployment benefits and the state will make a determination based on the standards they have.

Additional helpful resources:

How does the Families First Act impact how I manage my nanny or caregiver?

How does the Families First Act impact how I manage my nanny or caregiver?