In-home senior care is one of the fastest-growing segments of the care industry. The rising cost of facility-based care, coupled with a desire by many seniors to age at home, makes in-home care an increasingly popular option for families.

Additionally, the Department of Labor’s 2015 repeal of the companion care exemption for third-party employers (i.e. staffing agencies) have driven up operating costs, and, therefore, hourly rates for their clients. This is especially true for seniors with Alzheimer’s Disease or dementia because they generally need a caregiver to work long hours and respond better to having the same caregiver in their home day in and day out.

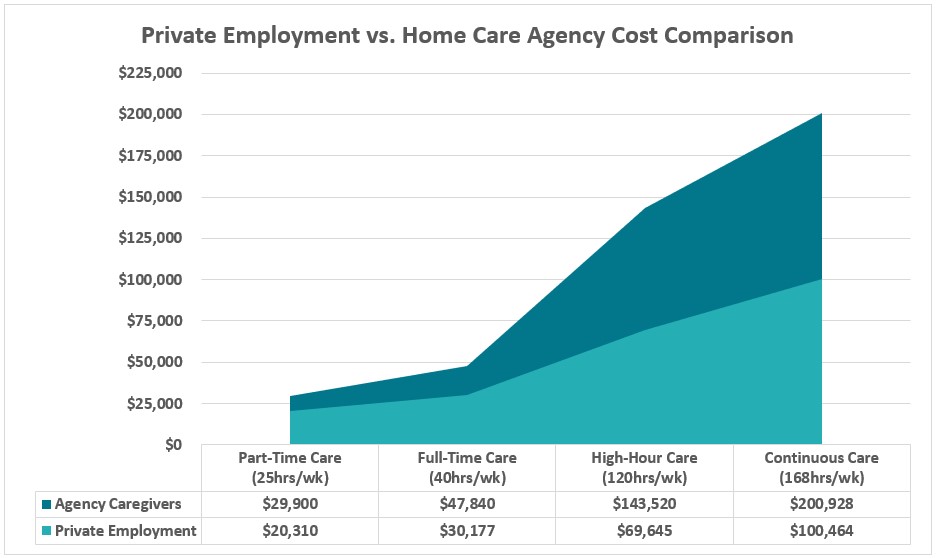

With this evolving trend in the senior care industry, families have increasingly turned to hiring caregivers on their own, which is sometimes called a direct hire solution. The advantage with this option is that in most states, families can take advantage of either the federal overtime exemption for live-in employees or the companion care exemption to lower their care budget by potentially tens of thousands of dollars. In the graph below, you can see that, as hours rise, the cost differential between agency-directed care and consumer-directed care grows dramatically.

* Costs are determined by national averages and 2019 research via Genworth and the US Census Bureau. Private employment figures include caregiver wages ($11.50/hr), payroll taxes, hiring a tax & payroll service and workers’ compensation insurance. The 120-hour case assumes 24-hour care for 5 days per week. Agency costs include an average agency rate of $23/hr, which encompasses overtime, insurances and business overhead.

Families looking for a more affordable option for in-home care should consider hiring privately. Before going that route, here are some household employment rules to keep in mind.

Senior caregivers hired privately are employees, not independent contractors

There is a common misconception that senior caregivers privately employed in the home can be treated as independent contractors so that payroll taxes can be avoided. However, the IRS has ruled that these workers should be classified as employees because the family has the right to control how, what, when or by whom the work should be performed. It doesn’t matter how many hours they work, how much they are paid or what they are called in a work agreement. Misclassifying a household employee as an independent contractor is considered tax evasion in the eyes of the IRS and can result in significant penalties from the state and the IRS.

Wage and hour laws to understand when hiring a senior caregiver

Senior caregivers are classified as non-exempt workers under the Fair Labor Standards Act. As such, families need to be aware of, and comply with, the following labor laws:

Caregivers must be paid at least the federal minimum wage of $7.25 per hour for each hour in the standard workweek. Many states (and some municipalities) have a minimum wage that is higher than the federal minimum wage. In these areas, employees must be paid at the highest rate. Check the minimum wage rate in your state.

Except for the live-in and companion care exemptions noted previously, senior caregivers must be paid overtime for each hour worked over 40 in a seven-day workweek. Some states have special overtime provisions that override these overtime exemptions.

The Department of Labor has created a fairly narrow definition of what a companion worker is. These types of caregivers have a primary focus on providing fellowship and protection. That means no more than 20% of their time can be spent on work activities such as dressing, meal prep, cleaning, etc. The rest of the time is spent on fellowship activities, such as watching TV, playing games, taking walks and ensuring the safety and well-being of the patient. If this definition of companion is not met, the caregiver is entitled to overtime pay.

Household employers are not required by federal law to provide paid sick days, holidays or vacation days to a senior caregiver. A growing number of states and municipalities have special requirements for paid sick leave and paid time off and, generally speaking, it’s a good idea to offer these benefits to attract a quality caregiver.

In many states, household employers are required to carry a workers’ compensation insurance policy. Workers’ comp pays for lost wages and medical expenses if the employee has a work-related injury or illness. Although not required in all states, families need to understand that whether required or not employers can be held liable for the benefits that would have been awarded in a workers comp claim. This can create tremendous financial exposure, so we recommend that all families employing a senior caregiver consider workers’ comp insurance.

Tax breaks are available when you pay a senior caregiver legally

Families that employ a caregiver and pay them legally can take advantage of tax breaks that can significantly reduce their employer payroll taxes. Generally speaking, the following four tax breaks are available to families, but eligibility is determined by each family’s personal situation.

Medical Care Tax Deduction (itemized deduction for qualifying medical expenses).

Dependent Care Account (a type of Flexible Spending Account specifically for dependent care needs).

Dependent Care Tax Credit (IRS Form 2441).

Medical Flexible Spending Account (used only for medical care).

As with most tax breaks and rules, there are a few notes and exceptions:

To capitalize on either of the dependent care tax breaks, families must pass the work-related test, meaning both spouses must be employed or full-time students and the person receiving care must pass the qualifying persons test (generally a dependent).

To qualify for either of the medical tax breaks, the care must be prescribed by a licensed healthcare professional. However, the care does not have to be performed by a nurse or healthcare professional.

The same expenses cannot be applied to more than one tax break.

Understandably, families may feel overwhelmed by all the household employer obligations. It’s a lot to manage which is why mistakes and oversights are easy to make. The best prevention is to consult with an expert like HomePay during the hiring process. Contact us for guidance on your specific situation and we can go over the many state-specific tax and labor law nuances so you’ll feel comfortable hiring someone to work in you or your loved one’s home.

Next Steps: